Announcing the Governmentwide Agenda for the Fall Training Conference – The 2025 Federal Market: What’s Next?

The Coalition is thrilled to unveil the agenda for the governmentwide day of our 2024 Fall Training Conference – The 2025 Federal Market: What’s Next?! The governmentwide day on November 20 will feature expert panels addressing “what’s next” after the election for the future of federal procurement. Attendees will gain insights into a range of timely topics, including the next steps for procurement policy and the Federal Acquisition Regulation (FAR), the evolving budget and market landscape, and advancements in artificial intelligence (AI), cybersecurity, and cloud technologies. Additionally, we’ll explore what’s next for the General Service Administration’s (GSA) programs, interagency contracting, and agency acquisition systems. Join us as we dive into what lies ahead for federal procurement in 2025 and beyond!

Agenda Highlights

*Please note, all speakers are invited unless otherwise noted as confirmed.

Keynote Address – Post-Election: What Happened, Where Are We, and Where Are We Going?

The conference will kick off with a Keynote Address, titled “Post-Election: What Happened, Where Are We, and Where Are We Going?,” delivered by Former Congressman and current Holland & Knight Partner Tom Davis (confirmed). During his remarks, Former Congressman Davis will provide an in-depth analysis of the results of the election and its far-reaching implications for the federal market and procurement policy.

Market and Procurement Outlook Panel: What’s Next?

During this panel, industry experts will provide market intelligence in the wake of the election on anticipated shifts in the federal market, the budget, policies, and acquisition strategies.

- Brian Friel, Co-Founder, BD Squared (confirmed)

- Kevin Plexico, Senior Vice President, Information Solutions, Deltek (confirmed)

- David Taylor, Founder & CEO, Federal Budget IQ

FAR Council & Beyond Panel: What’s Next?

Procurement executives from the FAR Council will discuss the rulemaking process and the role that the Council plays.

- Jeff Koses, Senior Procurement Executive, GSA

- John Tenaglia, Principal Director, DPCAP, DoD

- Karla Smith Jackson, Assistant Administrator for Procurement, NASA

Cybersecurity, Cloud, & AI Panel: What’s Next for the Federal Market?

Government and industry experts will explore cutting-edge advancements in AI, cloud, and cybersecurity, as well as challenges and best practices in these critical areas. Panelists will discuss the impacts of emerging technologies and share strategies to address the latest security and other compliance requirements for contractors.

- Moderator: Townsend Bourne, Partner, Sheppard Mullin

- Drew Myklegard, Deputy Federal CIO, OMB

- Eric Mill, Executive Director Cloud Strategy, TTS, GSA

GSA Federal Acquisition Service (FAS) Panels: What’s Next?

Leadership from several GSA FAS categories will be in attendance to discuss their upcoming priorities, programs, and initiatives. Attendees will have the opportunity to hear from key executives from:

- The General Supplies and Services (GSS) Category

- The Information Technology (IT) and Professional Services & Human Capital (PSHC) Categories

- The Assisted Acquisition Services (AAS)

- The Customer and Stakeholder Engagement (CASE) Office

Following the mainstage panels, the conference will shift into the afternoon “Nuts, Bolts, & Clicks” Breakout Sessions. Attendees will be able to choose from several program-specific sessions to engage in dialogue with key government personnel on topics such as E-Commerce, GSA IT Schedules, Governmentwide Acquisition Contracts (GWACs), and more.

In addition, popular “Ask the PMO” Tables will return for both days of the Fall Training Conference. On November 20, tables include:

- GSA MAS PMO

- GSA Pricing Tools

- Ask the Med/Surg Supply BPAs

- Ask the SAM.gov PMO

- VA Federal Supply Schedule (FSS)

To view the draft agenda for the governmentwide day, click here.

To register for the Fall Training Conference on November 20-21 in Falls Church, Virginia, click here. Click here to Book your group rate at the Fairview Park Marriott. We look forward to seeing you to discover “what’s next” in federal procurement!

Other Upcoming Events

The Coalition will have a packed calendar leading up to the Fall Training Conference! Check out the list of upcoming events and register below:

- October 3: Webinar: Bid Protests and Other Recent Federal Contract-Related Litigation – and Impacts on Contractors – Click here to register.

- October 9: Imaging Equipment Committee Meeting with MAS Office Management Branch – Virtual. Click here to register.

- October 10: Webinar: The Nuts, Bolts, & Clicks of CMMC – Click here to register.

- October 23: IT/Services Committee Meeting with GSA ITC Assistant Commissioner – Arlington, VA. Click here to register.

- October 24: Annual VA National Acquisition Center (NAC) Dialogue with Industry – Falls Church, VA. Click here to register.

- October 28: Webinar: 2024 (2025 FCPs) Public Law Pricing Update for Covered Drugs – Click here to register.

- November 19: Small Business Summit – Reston, VA. Click here to register.

Join Our Sponsor Lineup for the 2024 Fall Training Conference!

Thank you to our current sponsors of the Fall Training Conference!

The Coalition for Government Procurement is pleased to announce that multiple sponsorship packages are still available for the 2024 Fall Training Conference – 2025 Market Outlook: What’s Next? As always, the Fall Training Conference will serve as a unique opportunity to engage with Federal procurement leaders and connect with industry colleagues.

Secure your sponsorship today and showcase your organization’s brand to the Federal acquisition community.

Click here to download the Sponsorship Prospectus.

NEW For Fall Training Conference – Mobile Event App Sponsorship

We are excited to offer an exclusive sponsorship opportunity that puts your company front and center at our upcoming Fall Training Conference. By sponsoring our mobile event app, your company will gain prime exposure to all conference attendees throughout the entire two-day event.

Key Benefits of the Mobile App Sponsorship:

- Prime Home Page Placement: Your company’s name and logo will be prominently displayed on the home page of the conference app, ensuring maximum visibility every time an attendee opens the app.

- Constant Brand Visibility: The app will be the go-to resource for attendees, featuring peer-to-peer messaging and offering essential information like the conference schedule, session topics, speaker bios, and more. Your brand will be seen repeatedly, reinforcing your company’s presence and commitment to the industry.

*Pricing details included in the prospectus. For more information, please contact Heather Tarpley at htarpley@thecgp.org.

We look forward to partnering with you to make the Fall Training Conference a resounding success!

Continuing Resolution to Fund Government through December 20

On September 25, the Senate and House passed a short term continuing resolution (CR) that will fund the government through December 20, 2024, averting a government shutdown ahead of the September 30 deadline, reports The Hill. Passage of the CR comes after a spending bill that would fund the government for six months failed, and instead moves the appropriations debate to be resolved during the “lame-duck” period following the election. The President signed the CR on Thursday evening.

VA Working with Congress to Address Budget Shortfall

The US Department of Veterans Affairs (VA) recently reported a budget shortfall of approximately $3B in fiscal year (FY) 2024 and an additional $12B shortfall in funding for FY25. Earlier in September, Congress passed $3B in supplemental funding for the VA so that veteran benefit payments could be made October 1.

Congress did not include an additional $12B in funding for the VA in the current continuing resolution which will fund Federal agencies through December 20. The VA is continuing to work with Congress to address the budget shortfall. VA leadership is hopeful that the additional $12B will be included in an omnibus package (before or after Dec 20) that will fund the government through the end of FY25.

House Legislation to Increase the MPT and SAT

The House Oversight Committee advanced 13 bills last Wednesday, reports Federal News Network. In addition to the Value Over Cost Act (see below), the Committee advanced the Federal Improvement in Technology (FIT) Procurement Act, Federal Acquisition Security Council (FASC) Improvement Act, and Source Code Harmonization and Reuse in Information Technology (SHARE IT) Act.

The FIT Act would authorize agencies to make advanced payments for cloud computing services, increase the simplified acquisition threshold from $250,000 to $500,000 and the micro-purchase threshold from $10,000 to $25,000, and require Federal procurement officers to take cross-functional training.

The FASC Improvement Act would grant the FASC the ability to directly issue binding removal and exclusion orders to “protect the Federal supply chain from technology companies and products owned or controlled by a foreign adversary.”

The SHARE IT Act would direct agencies to share their custom-developed source code with each other to reduce duplicative software efforts. Agencies would be required to publicly list custom code that they develop or purchase on Code.gov, with exceptions for national security systems, classified software, or code that would create risks to individual privacy if disclosed.

GSA “Best Value” Bill Advances in the House

On September 20, Representative Byron Donalds (R-FL) announced that HR 9596, “The Value Over Cost Act,” advanced out of the Committee on Oversight and Accountability through a unanimous bipartisan vote of 39-0. The bill, introduced by Donalds, was designed “to provide the U.S. General Services Administration (GSA) with the contractual flexibility it needs to modernize antiquated Federal procurement procedures and increase efficiency. The legislation will also maximize the Federal Government’s ability to procure modern technology and help small businesses by reducing regulatory burdens.”

Additionally, the bill would provide GSA with additional flexibility to award contracts based on “best value” as opposed to solely focusing on the “lowest cost alternative.” According to Federal Acquisition Regulation (FAR) 2.101, best value is defined as “the expected outcome of an acquisition that, in the Government’s estimation, provides the greatest overall benefit in response to the requirement.”

NASA SEWP VI Timeline Update, Proposals Due December 18

On September 20, NASA published an update regarding the SEWP VI Request for Proposal (RFP) after undergoing a six-week strategic pause to address industry concerns. As a result of the strategic pause, NASA has outlined the following actions and timeline:

- Responses to ALL questions previously submitted to the SEWP VI Q&A Comment tool.

- Responses to these questions will be communicated in approximately three batches between October 1 and 22.

- The answers previously provided to Industry will remain as a resource to reference as a Frequently Asked Questions document.

- An additional two days to ask questions using the SEWP VI Q&A Tool.

- Subsequent Amendments addressing necessary edits to the solicitation.

- An Industry Day scheduled in November 2024, to discuss any substantive changes to the solicitation prior to proposal receipt.

Tentative Schedule:

- Provide Industry Answers to Current Questions (i.e. all ~6,800 questions received to date)- October 1- 22

- Additional Questions Period- October 22-24

- All Amendments and Answers to any Additional Questions- NLT November 4

- Industry Day-November 2024

- SEWP VI Proposal Submission Due Date- DECEMBER 18, 2024 at 12:00 PM (ET)

GSA Outlines Efforts to Streamline Federal Procurement

Mark Lee, GSA Assistant Commissioner for the Office of Policy and Compliance, discussed the Federal Acquisition Service’s (FAS) efforts to streamline Federal procurement in an interview with Federal News Network. Lee shared updates on the FAS Catalog Platform initiative, which looks to “modernize and streamline the systems, processes, and policies used to manage the data associated with 80+ million products and services offered to the Federal marketplace, including those on GSA Advantage.” A recent update integrates catalog data and transactional line-item data, giving GSA the ability to share transactional line-item data with vendors before a modification. This update allows vendors to better understand their competitiveness, while also reducing the average time to modify a contract from 34 days to two or fewer. The update has been expanded across all products and is being piloted for services. GSA has collected feedback from vendors, its acquisition workforce, and customer agencies on how to improve the platform.

During the interview, Lee also discussed GSA’s efforts to lower procurement acquisition lead time (PALT). To reduce PALT, FAS has looked to the Commercial Platforms program, which includes “pre-negotiated agreements across the Federal Government with eight commercial marketplaces” that purchase card holders can utilize. According to internal surveys, GSA has seen significant time savings for customers through the program, with an 80 percent reduction in time spent making purchases. GSA is also looking to reduce PALT through oral and video presentations for technical evaluations. According to Lee, “the use of oral and video presentations ha[s] dramatically streamlined the source selection process.”

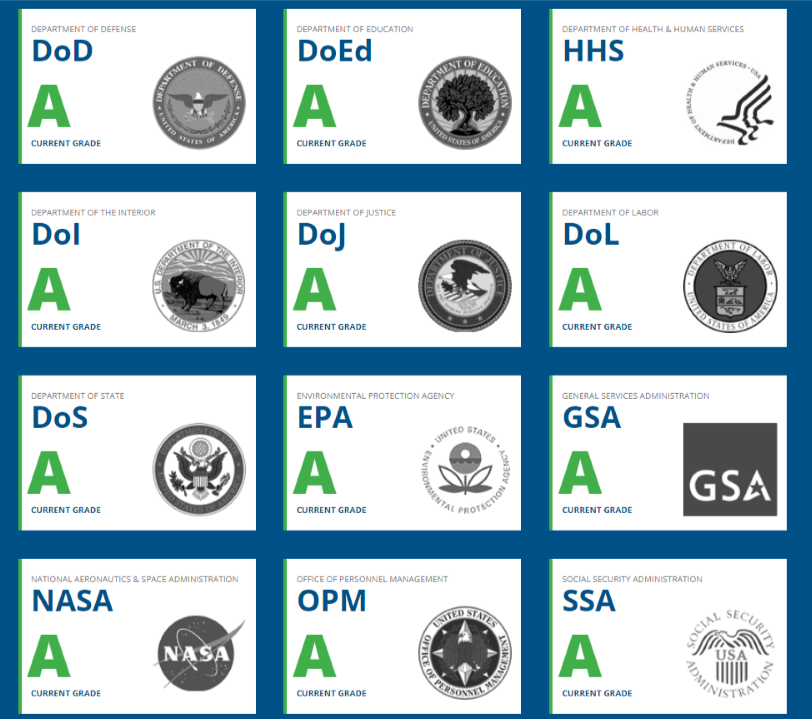

Record Number of Agencies Earn “A” on Latest FITARA Scorecard

Federal News Network reports that 13 agencies received an “A” letter grade in the latest Federal IT Acquisition Reform Act (FITARA) scorecard. An additional 10 agencies received a “B,” primarily due to overall IT and cybersecurity management challenges. One agency received a “C,” the lowest grade awarded. These results were an overall improvement from February’s FITARA scorecard grades. To date, agencies have achieved over $30 billion in cost savings and cost avoidance under FITARA.

The overall improvement in grades can be primarily attributed to major improvements in the Chief Information Officer (CIO) investment evaluation and cloud computing categories. 23 agencies received an “A” in the CIO investment category, which tracks the percentage of IT investments evaluated by the CIO within the last two years. Eight agencies received an “A” in the cloud category, which measures whether agencies adopted five key cloud procurement requirements from the Office of Management and Budget’s (OMBs) Cloud Smart Policy. “Steady progress” was also noted in the cyber category.

Future versions of the scorecard may look at adding reforms to FedRAMP, as well as a category on AI training and recruiting in the Federal workforce.

GSA Tracking Emerging Technologies

According to MeriTalk, GSA has developed a new “radar” process to track the development of emerging technologies. Laura Stanton, Assistant Commissioner of GSA’s Office of IT Category, said that the radar will “help the acquisition community anticipate the impact technologies such as AI and quantum computing will have on the public sector.” She added that GSA is working with the National Institute of Standards and Technology (NIST), Cybersecurity and Infrastructure Security Agency (CISA), academic institutions, and industry to track these emerging technologies. The radar consists of four development areas:

- The preliminary “outline” area focuses on technologies in their lab testing or initial stages.

- The second area focuses on determining if a technology has “business value.”

- The third area examines company use cases of the technology.

- The final area focuses on the technology’s potential use in the Federal space.

GSA is also creating an AI Acquisition Advisory Committee composed of government, industry, and academia representatives who will “advise the government on the use of AI.”

Status of CMMC 2.0 Final Rule

Meritalk reports that the Department of Defense Cybersecurity Maturity Model Certification (CMMC) final rule was cleared by the Office of Information and Regulatory Affairs (OIRA) on September 13. The CMMC final rule had been under OIRA review since June. Congress now has a maximum of 60 days to review the rule. If no action is taken by Congress during this period, the rule will automatically take effect.

Member Input on DFARS Rule Implementing CMMC Due Today

Thank you to everyone who has submitted their feedback on the proposed rule amending the Defense Acquisition Regulations Supplement (DFARS) to incorporate contractual requirements for the Cybersecurity Maturation Model Certification (CMMC) 2.0 program.

The CMMC 2.0 Program requirements apply to all Department of Defense (DoD) solicitations and contracts pursuant to which a defense contractor or subcontractor will process, store, or transmit Federal Contract Information (FCI) or Controlled Unclassified Information (CUI) on information systems, including those for the acquisition of commercial items (except those for commercially available off-the-shelf (COTS) items) valued at greater than the micropurchase threshold (MPT).

According to the proposed rule, DoD plans to implement a phased rollout of CMMC. DFARS clause 252.204-7021, Contractor Compliance with the CMMC Requirements, will be used in solicitations and contracts that require contractors to have a specific CMMC level, including those using FAR Part 12 for commercial products and commercial services, with the exception of COTS items. In the first three years following publication of the final rule, DoD program offices and requiring activities will determine whether to use clause DFARS 252.204-7021 in contracts and solicitations. In the fourth year following the 3 year “phase-in” period, CMMC will apply to all applicable DoD solicitations and contracts, including those for the acquisition of commercial products and commercial services (except for COTS items), valued at greater than the MPT. The required CMMC level will be identified by DoD in the solicitation or contract. According to the proposed rule, CMMC level certification must be achieved prior to contract award and maintained throughout the duration of the contract. In addition, CMMC requirements must be flowed down to subcontractors at all tiers, “when the subcontractor will process, store, or transmit Federal contract information or CUI.”

Comments on the proposed rule are due on or before October 15, 2024.

Please submit comments and any feedback on the proposed rule by September 27 to Greg Waldron at gwaldron@thecgp.org.

Nominations Now Open for the 2024 Excellence in Partnership Awards!

The Coalition for Government Procurement is excited to announce that nominations are now open for the 2024 Excellence in Partnership (EIP) Awards!

The EIP Awards recognize individuals and organizations in the Federal procurement community who have made significant contributions to the acquisition system. The awards recognize individuals and programs from the Department of Defense, civilian agencies, and industry. Throughout the years, the EIP Awards have highlighted a number of outstanding efforts, programs, and initiatives led by procurement professionals who are dedicated to meeting the mission critical needs of agencies and the American people.

2024 EIP Awards categories:

Lifetime Acquisition Excellence Award – Presented to an individual in the contracting community (government or industry) for demonstrating a life-long commitment to advancing “common sense in government procurement.”

Acquisition Excellence Award – Presented to an organization or individual (government or contractor) for outstanding performance over the year in meeting the mission-critical needs of a Federal agency.

Sustainable Excellence Award – Presented to a government agency or contractor that has made outstanding contributions that meet the Federal Government’s sustainability goals.

Advocating for Veterans Award – Presented to an organization or individual (government or contractor) for promoting and executing a successful program or policy that supports veterans.

We strongly encourage you to nominate a deserving colleague or collaborator who has demonstrated their commitment and expertise in the Federal procurement space. The nomination deadline is October 4, 2024.

To submit a nomination, click here.

If you have any questions regarding the EIP Awards or nomination process, please contact our EIP Award team at nominations@thecgp.org.

Legal Corner: How SBA’s Proposed Size, Status Recertifications Rule Could Impact Small Business M&A

The Legal Corner provides the procurement community with an opportunity to share insights and comments on relevant legal issues of the day. The comments herein do not necessarily reflect the views of The Coalition for Government Procurement.

Authored by Robert K. Tompkins | David S. Black | Amy L. Fuentes | Kelsey M. Hayes | Leila S. George-Wheeler; Holland & Knight

The U.S. Small Business Administration (SBA) on Aug. 23, 2024, issued a Proposed Rule that significantly changes the effect of recertifications of size and socioeconomic status under set-aside contracts following a merger or acquisition of a contractor with small business awards. Comments are due on Oct. 7, 2024. If finalized in its present form, the proposed rule could impact the valuation of small business pipelines by eliminating post-mergers and acquisitions (M&A) transaction eligibility for orders under restricted multiple award contracts (MACs) and set-aside orders under Federal Supply Schedule (FSS) contracts. Because SBA states that many of its proposed rule changes are “clarifications” of its existing rules, potential M&A buyers should consider the effect of SBA’s proposed rule in their valuation of small business targets even before the rule is finalized. Affected concerns should also strongly consider filing comments on the proposed rule to ensure their perspectives are taken into account by SBA in its formulation of the final rule.

Background and Context

The valuation of a small business acquisition target is based in part on the income it can be expected to generate for the buyer after the acquisition closes. When an acquisition target has small business set-aside contracts, buyers understand a transaction may limit the target’s eligibility for future set-aside contracts. But under present SBA rules, there is a presumption of continuing eligibility for remaining option periods under existing set-aside contracts and future task orders under certain “MACs.” A buyer will typically include an assessment of the revenue that can be expected from an acquisition target’s remaining set-aside contracts, including future task orders under MACs.

It is common for an M&A involving a small business contractor to result in a change to its size or socioeconomic status. This is because the contractor becomes “affiliated” and “controlled” for size and status purposes with its buyer by virtue of the transaction. Since 2006, small business contractors have been required to recertify their size and socioeconomic status within 30 days of an M&A transaction involving a sale of equity or a finalized novation in a transaction involving the sale of assets related to a business segment. However, a recertification that the contractor was no longer small did not necessarily require termination of the set-aside contract(s). Rather, it merely required that the awarding agency cease taking credit for its small business goals.

Until November 2020, post-M&A size and status recertifications did not impact a contractor’s eligibility for remaining option periods under set-aside contracts and orders or the awarding of future set-aside task orders under any kind of multiple-award indefinite delivery/indefinite quantity (IDIQ) contract (restricted, unrestricted and FSS). Moreover, closing a transaction while set-aside proposals or offers were still pending did not change a seller’s eligibility.

In November 2020, SBA issued a final rule that changed the effect of post-M&A recertifications on eligibility for new task orders under unrestricted MACs (except for FSS contracts, which continued to follow the prior rule). In addition, the November 2020 rule changed the effect of a post-M&A size recertification on eligibility for pending proposals for set-aside awards. If the transaction closed within 180 days of proposal submission, the contractor was no longer eligible to receive a set-aside contract or a set-aside task order under an unrestricted MAC or FSS contract. (SBA’s Office of Hearings and Appeals interpreted the November 2020 final rule as not impacting eligibility for task orders under restricted IDIQ contracts.)

Now, four years later, SBA is proposing to expand further the disqualifying impact of post-M&A recertifications on eligibility for new set-aside task orders, pending proposals and even option periods under MACs.

Key Changes Regarding the Effect of Post-M&A Recertifications of Size and Status

As an overarching matter, SBA is proposing to consolidate and relocate its recertification requirements for all its size and status programs in a single, new section of its regulations: 13 CFR 125.12. Three of the biggest proposed changes from the Proposed Rule that could negatively impact small business valuations are the following:

No Future Task Orders or Options Under Restricted Multiple Award Contracts. Since SBA first required post-M&A recertifications in 2006, a recertification as “other than small” has had no impact on a contractor’s eligibility for future task orders or task orders under MACs that were restricted to small businesses or a subcategory based on socioeconomic status (unless the contracting officer requested an order-specific representation). As long as there was no order-specific representation requested at the order level, contract holders remained eligible for future task orders and option periods even though they represented as “large” or without the required status following the relevant M&A transaction.

SBA is proposing to change this. Under proposed section 13 CFR 125.12, SBA would establish a “disqualifying representation” following an M&A transaction. A holder of a restricted MAC, whose recertification removes their size or SBA status, would be ineligible for future task orders or option periods. As the Proposed Rule states:

If a concern has a disqualifying recertification in response to any triggering event for recertification, aside from a contracting officer request for recertification on a specific order or agreement, the concern is ineligible to submit an offer for a set aside or reserved award under a multiple award contract after the triggering event occurs. (Emphasis added.)

Unlike the current regulation, it would no longer matter whether the MAC itself was restricted or unrestricted.

Thus, if the proposed rule is finalized, for acquired firms that must recertify as other than small, they will not be eligible for future set-aside task orders under restricted MACs. Without the possibility of future new income streams from set-aside orders under these contracts, this could adversely impact the valuation of a contractor holding such contracts when an M&A transaction is likely to result in a disqualifying representation.

No Future Restricted Task Orders Under FSS Contracts. If finalized, SBA’s proposed rule would have a similar impact on restricted task orders under a General Services Administration (GSA) FSS contract. GSA FSS contracts are unrestricted MACs. Under SBA’s current regulations, FSS contracts are excepted from the rule that applies to restricted task orders under unrestricted MACs. This is consistent with FAR 8.405-5, which provides that in the absence of a contracting officer’s request for an order-specific size representation, size for a restricted task order under a FSS contract is made “at the contract level” – i.e., based on the contract holder’s size and status representations at the time it submitted its proposal for its initial FSS contract award or at the time of its size and status representations at the time it secured its current five-year option period. (A different rule applies for sole-source task orders made to 8(a) contractors.)

Under the proposed rule, SBA seeks to “clarify” that though it has excepted FSS contracts from the general recertification rule applicable to unrestricted MACs, that exception does not apply to future set-aside orders when a disqualifying recertification is required:

If there is a disqualifying size recertification in response to any event in [new proposed] § 125.12, including a merger, sale, or acquisition, the concern must notify the contracting officer for the underlying multiple award contract and the contracting officer for all existing orders, and update its SAM.gov profile to reflect its current size status. The concern is no longer eligible for set-aside orders or agreements against the FSS MAS [Multiple Award Schedule]. In those instances, size is determined as of the date that the triggering event occurred or offer for the particular order or agreement, depending on the cause for recertification. (Emphasis added.)

Thus, under the proposed rule, a post-M&A disqualifying size or status representation will render a FSS contract holder ineligible for future restricted task orders under its FSS contract, even if the contracting officer does not request an order-specific representation. If the proposed rule is finalized, for acquired firms that must recertify as other than small, they will not be eligible for future set-aside task orders under FSS contracts.

Loss of Eligibility Under Pending Proposals for Set-Aside or Reserved Contracts and Orders. Since November 2020, SBA’s regulations have required offerors to promptly notify contracting officers of a change in control caused by M&A activity and recertify size for any pending proposals for set-aside contracts and task orders. If the transaction triggering the recertification occurred within 180 days from submission of the proposal, a disqualifying recertification rendered the offeror ineligible for the contract or proposal. As noted in the Notice of Proposed Rulemaking (NPRM), recent SBA Office of Hearings and Appeals (OHA) cases have been construed to hold that the “180-day” rule does not apply in the case of task orders under restricted MACs. This meant that buyers have been able to assign potential value (depending on how they assess the seller’s potential winning percentage) to pending task order proposals under such restricted MACs.

SBA’s NPRM states that the agency believes these cases misconstrued the intent of the 180-day rule. SBA is proposing to clarify its intent and treat restricted task order proposals the same way as proposals for other set-aside contracts and task orders. Therefore, under the proposed rule, if a novation, merger, acquisition or sale triggers a disqualifying recertification that happens within 180 days after the offer date but before the award is made, the entity is ineligible to receive the pending small business set-aside award, even though it is under a restricted MAC.

SBA’s NPRM also goes on to extend the disqualifying recertification even in cases where the task order award is made more than 180 days after the triggering event (i.e., the merger or acquisition). Thus, if the pending proposal is for a task order under a set-aside MAC, the concern is ineligible for award because the concern is not eligible for set-aside orders. (This will be true regardless of whether the transaction occurred more than 180 days after proposal submission.) This means buyers would be less likely to assign value to pending proposals for task orders under restricted MACs.

Questions Remain About the Timing of the Applicability of SBA’s Implementation of Elements of Its Proposed Rule

The proposed rule is unclear as to the timing of its changes, particularly as it relates to MACs awarded before the effective date of the final rule. There is a related question as to whether SBA can retroactively apply its proposed rule to restricted MACs and FSS contracts awarded before the rule takes effect. Even though the proposed rule would make significant policy changes with respect to the impact of post-M&A recertifications on task orders under restricted MACs and FSS contracts, SBA refers to these changes as mere “clarifications.” This may signal an intent by SBA to apply this retroactively – as a clarification is not a change that is barred by retroactive application. As currently written, the Proposed Rule does not identify when it will become effective or whether it will apply to recertifications submitted prior to SBA’s issuance of a final rule. As such, small business concerns that have already undergone, or are considering, a sale of their business have relied upon the current SBA regulatory regime in making business valuation and sale decisions. Based on existing case law, companies and acquirers might have assigned significant value to eligibility for future task orders and options during the life of certain MACs, which enhances the company’s attractiveness and marketability.

Based on how SBA applied and enforced its November 2020 rulemaking (which changed size and status eligibility for restricted task orders under unrestricted MACs), it will not be surprising if SBA asserts that the rule applies to all task order procurements under existing restricted MACs and FSS contracts, including those that were awarded before the final rule’s effective date. In a case addressing whether the November 2020 final rule applied to an IDIQ contract awarded in 2015, SBA’s OHA concluded that the final rule applied to task orders awarded under existing contracts, explaining it this way:

Elsewhere in the regulatory preamble, however, SBA explained that its intent was to close a loophole in its regulations, whereby set-aside orders might be awarded to large businesses under unrestricted MACs, even though the contractor’s “size and status were not relevant to the award of the underlying MAC.” (citation omitted) Given SBA’s stated concerns, the revisions to § 121.404(a)(1)(i)(A) are most reasonably understood as applying to all orders issued after November 16, 2020. This is true because there is no indication in the regulations or the accompanying commentary that SBA intended to permit the loophole to continue indefinitely, until such time as all unrestricted MACs expired. Certainly, SBA could have included language in the rule exempting previously-awarded MACs if that had been SBA’s intent.

Avenge, Inc., SBA No. SIZ-618, 2022 WL 17423607.

It seems likely SBA will seek to have this final rule applied similarly. (One topic for comments on the proposed rule may be to get SBA to expressly address whether a Final Rule will apply to task orders issued under previously awarded contracts.)

However, a question remains as to whether such a Final Rule can be given such retroactive effect. It is established that a regulatory amendment that “creates a new obligation, imposes a new duty, or attaches a new disability, in respect to transactions or considerations already past” cannot be given retroactive effect to previously solicited contracts. Kearfott Guidance & Navigation Corp. v. Rumsfeld, 320 F.3d 1369, 1374 (Fed. Cir. 2003). There is a question of whether restricting size and status eligibility for future restricted task orders under restricted MACs and FSS contracts creates a “new disability” in respect to those contracts that would prevent retroactive application.

There may also be questions about whether SBA is exceeding its statutory authority in unilaterally implanting a policy change this significant without new legislation from Congress. As the U.S. Supreme Court has noted recently, agencies have “only those powers given to them by Congress and an agency’s ‘enabling legislation’ is generally not an ‘open book to which the agency [may] add pages and change the plot line.'” West Virginia v. Env’t Prot. Agency, 597 U.S. 697 (2022). Federal courts “presume that ‘Congress intends to make major policy decisions itself, not leave those decisions to agencies.” Id. Following the Supreme Court’s decision earlier this year overruling the Chevron deference previously afforded to federal agencies on matters of ambiguous statutes, “[c]ourts must exercise their independent judgment in deciding whether an agency has acted within its statutory authority.” Loper Bright Enters. v. Raimondo, 144 S.Ct. 2244 (2024).

Holland & Knight does not intend to take a position on any of these questions through this blog. We intend only to note their existence and that they may be raised in the future before and after SBA finalizes its rulemaking.

A Procedure for Formal Size Determinations Following Post-M&A Size Recertifications

SBA is also proposing to provide a procedure for stakeholders, including competing MAC holders, to police the accuracy of post-M&A size recertifications. M&A activity is often public knowledge through press releases. It is already common practice for competitors to raise questions about a concern’s size based on published information about recent M&A activity. However, there is currently no mechanism for the government or a competitor to request a review of the accuracy of a post-M&A size recertification.

The Proposed Rule also seeks to specifically authorize requests for formal size determinations relating to size recertifications required by the new proposed 13 C.F.R. § 125.12. Because the proposed rule would render a concern ineligible for orders set aside for small businesses or set aside for a specific type of small business under a MAC where the concern submits a disqualifying recertification, SBA proposes to authorize any contract holder to request a formal size determination of another contract holder following a post-M&A size recertification relating to a MAC. Formal size determinations could also be requested by the contracting officer, the relevant SBA program manage, or SBA’s Associate General Counsel for Procurement Law.

Although unrelated to post-M&A recertifications, it is also worth noting that SBA is proposing to allow a size protest in connection with the award of an order issued under a multiagency MAC, where the protest relates to the ostensible subcontractor rule (because it is at the order level, not the MAC level, where undue reliance may become an issue). SBA’s NPRM invites comments on this concept.

Potential Impacts of the Proposed Rule

SBA’s Proposed Rule, if finalized with the current language, seems likely to change the M&A landscape for small business government contractors. By eliminating eligibility for future task orders and options under restricted MACs and future restricted task orders under FSS contracts, the proposed rule would reduce the amount of future revenue a buyer could expect a small business acquisition target to generate if the transaction causes the target to make a “disqualifying” recertification. Less expected future revenue generally means a lower valuation.

Beyond these obvious impacts on the M&A market, the downstream effects of these proposed changes are likely more significant than SBA may be aware. Small businesses often attract top executive talent that are instrumental in growing their businesses by offering executive compensation packages that are frequently structured with earn out provisions that compensate these individuals based on future company performance. Additionally, many small businesses grow through minority investment activities by private equity groups. Shorter runway periods and less favorable exit strategies for small businesses based on the proposed regulatory changes are likely to disincentivize executives or a private equity group’s intent to invest in the company, which can impact a small business’s ability to grow.

Conclusion

Holland & Knight will continue to monitor developments regarding the Proposed Rule and provide updates. Public comments on the proposed rule are currently due by Oct. 7, 2024. We will also publish a series of other blogs regarding other changes to SBA’s regulations included in the Proposed Rule, such as changes to the Mentor-Protégé Program, 8(a) Program and others. Please contact the authors if you have specific questions for your business.

Annual VA NAC Dialogue with Industry, October 24

The Coalition for Government Procurement is pleased to announce that its Annual Meeting with the VA National Acquisition Center (NAC) will be Thursday, October 24 at the Fairview Park Marriott in Falls Church, VA.

The Annual VA NAC meeting is one of the most popular events for our Healthcare members. This year’s event will feature VA leadership from the VA Federal Supply Schedules (FSS) program as well as the National Contract Service (NCS). For the first time, we will also hear from acquisition leaders with the Commodity & Services Acquisition Center (CSAS) and the Denver Logistics Center (DLC)! The VA OSDBU has also been invited to participate with a tabletop.

The program will cover the latest developments for VA FSS, CSAS, DLC, and NCS contracts and public law pricing topics for pharmaceutical members. There will also be time to network with leadership of these contracting programs.

VA speakers include:

- Christopher Parker, Associate Executive Director, Strategic Acquisition Center & Acting Associate Executive Director, National Acquisition Center

- Dan Shearer, VA Federal Supply Schedule (FSS) Director

- Fran DeRosa, VA National Contract Service (NCS) Director

- Andrea Lay, Director, Commodity & Services Acquisition Service (CSAS)

- Kevin Quitmeyer, Director, Denver Logistics Center (DLC)

- Diana Lawal, Chief, Pharmaceutical/Dental Team B Division and Chair, Public Law Pricing Group

Annual VA NAC Meeting Agenda:

- 7:30 am – 9:00 am: Registration

- 9:00 am – 9:15 am: Introduction Remarks from the VA

- 9:15 am – 10:15 am: VA NAC Directors Panel

- 10:15 am – 11:00 am: Networking

- 11:00 am – 12:00 pm: VA NAC Federal Supply Schedule Panel

- 12:00 pm – 12:30 pm: Final Q&A

For the detailed agenda with all speakers, click here.

This members-only meeting will be in-person and complimentary. To register, click here. For questions or assistance with registration, please contact Madyson Whiting at MWhiting@thecgp.org.

View from Main Street: The Rule of Two and the Nonmanufacturer Rule

Updates on Timely Topics Impacting the Government Contracting Industry from the Coalition’s Vice President of Acquisition Policy, Ken Dodds

The contracting officer believed that the Small Business Administration (SBA) had issued a class waiver of the nonmanufacturer rule (NMR) for sonar sounding sets. The contracting officer conducted market research and found more than two small businesses that could provide the equipment and set the solicitation aside for small business. Two offerors submitted proposals. The protester would be supplying a product made in Canada. After receipt of proposals, the contracting officer determined that the class waiver of the NMR did not apply to the equipment it was purchasing. The procuring agency informed the protester that it was ineligible for award, because it was not supplying the product of a small business made in the United States.

The procuring agency informed the firm that it was awarding to the other offeror. The firm filed a protest on the grounds that the solicitation did not contain the Federal Acquisition Regulation (FAR) clause (52.219-33) requiring offerors to comply with the NMR, i.e., supply a product made by a small business in the United States. In response to the protest, the procuring agency informed the Government Accountability Office (GAO) that it would take corrective action and amend the solicitation so that it contained the applicable NMR provisions, allow offerors to revise proposals, and then make a new award decision. GAO dismissed the initial protest as academic. Before final proposal revisions were due, the firm filed another protest, challenging the agency’s small business set-aside decision, arguing that it was based on flawed market research, i.e., the agency’s mistaken belief that a class waiver of the NMR existed. GAO sustained the protest.[1] At no point had the agency assessed whether two or more small businesses could comply with the NMR.

The facts of this case illustrate a peculiarity in small business set-aside supply acquisition. It does not appear that there are two small business manufacturers that can meet the agency’s requirement, so the small business rule of two cannot be met without an SBA waiver of the NMR. But SBA cannot grant an individual or class waiver of the NMR, which would allow the agency to set the acquisition aside by enabling small business offerors to provide the products of large or foreign businesses, if there is a single small business manufacturer of the product capable of meeting the solicitation requirements. With respect to an individual waiver of the NMR, SBA’s rules provide, “[i]f a small business manufacturer or processor is found for the product in question, the Director, Office of Government Contracting will deny the request.”[2] With respect to a class waiver of the NMR, SBA’s rules provide, “[a] waiver for a class of products (class waiver) will be granted when there are no small business manufacturers or processors available to participate in the Federal market for that class of products.”[3] There are rarely used procedures for a partial small business set-aside if the requirements for a total small business set-aside are not met.[4] A sole source award is also possible depending on the dollar value of the procurement and whether the one small business manufacturer has a socioeconomic certification (8(a), HUBZone, SDVO, WOSB). Otherwise, it would appear that the agency will have to issue the solicitation full and open.

[1] Knudsen Systems, Inc., B-422433.2, Aug. 09, 2024.

[2] 13 CFR 121.1204(b)(4)(ii).

[3] 13 CFR 121.1202(a).

[4] FAR 19.502-3.

Off the Shelf: Procurement Potpourri

Federal News Network Executive Editor Jason Miller joins Off the Shelf for “Procurement Potpourri,” a wide-ranging discussion of key procurement policy and program developments across the Federal market.

During the interview, Miller and host Roger Waldron tackle the state of interagency contracting, focusing on the status of the four major interagency procurements: OASIS+, CIO-SP4, NASA SEWP, and Alliant 3. The discussion highlights the role that the Office of Federal Procurement Policy has played in establishing and overseeing the IT GWACs and whether enough is currently being done.

Miller also shares his thoughts on the ever-growing cybersecurity regulatory regime, including CMMC, and the need for cyber harmonization. Finally, Miller talks about a new SBA report on the mentor-protégé program.

Listen to the full podcast here.

Army Turns to AI to Improve Contracting Workforce Efficiency

Meritalk reports that the U.S. Army is looking to utilize AI to assist its contracting workforce. The Army’s contracting workforce, which includes approximately 9,000 personnel, doubled its workload during the COVID-19 pandemic. With limited options for increasing its contract workforce, the Army’s Assistant Secretary of Acquisition, Logistics, and Technology is looking to technology to support the Army’s efforts. Pilot programs are underway to implement AI to streamline tasks such as market research, proposal writing, and contract evaluations.

Additionally, the Army is enhancing its contracting processes with new software tools, including a modern contract writing system developed in collaboration with the Air Force. The writing system looks to streamline contracting processes and enhance user experience through improved interfaces and functionality.

Webinar: Bid Protests and Other Recent Federal Contract-Related Litigation – and Impacts on Contractors, October 3

The Coalition will host a webinar, Bid Protests and Other Recent Federal Contract-Related Litigation – and Impacts on Contractors, on October 3 from 12:00 – 1:00 PM (ET). Guest presenters include Mayer Brown attorneys Luke Levasseur and Evan Williams. During the webinar, Luke and Evan will cover a number of key topics, including:

- Essential information about the bid protest process that every contractor should know

- Strategic considerations related to pursuing and intervening in bid protests

- Recent, noteworthy bid protest decisions

- Other important federal contract litigation

- Impact of Loper Bright and the end of Chevron deference on government contractors

To register, click here. For any assistance with registration, please contact Madyson Whiting at mwhiting@thecgp.org.

Imaging Equipment Committee Meeting with MAS Office Management Branch, October 9

On October 9 from 10:00 – 11:00 AM (ET), the Coalition’s Imaging Equipment Committee will host a virtual meeting with Michael Burrell, Senior Section Chief of the MAS Office Management Branch at GSA. Michael will provide an update on the Office Management segment, software attestation requirements included in the upcoming MAS modification, and the new economic price adjustment clause.

GSA has requested that members provide questions and topics that they would like discussed at the meeting. Please submit your questions and topics to Joseph Snyderwine at JSnyderwine@thecgp.org.

To register, click here. For any assistance with registration, please contact Madyson Whiting at mwhiting@thecgp.org.

New Webinar: The Nuts, Bolts, & Clicks of CMMC, October 10

The Coalition for Government Procurement is excited to host a new webinar, The Nuts, Bolts, & Clicks of CMMC, on October 10 from 12:00 – 1:00 PM (ET) with guest presenter Eric Crusius, Partner at Holland & Knight.

This session will cover what the Cybersecurity Maturity Model Certification (CMMC) program means for contractors and companies with access to Controlled Unclassified Information (CUI). Attendees will gain a clear understanding of the certification process, its impact on Federal contracting, and the steps required to ensure compliance with cybersecurity standards. This webinar will provide essential insights to help your organization prepare and succeed in today’s evolving cybersecurity landscape.

To register, click here. For any assistance with registration, please contact Madyson Whiting at mwhiting@thecgp.org.

IT/Services Committee Meeting with GSA ITC Assistant Commissioner, October 23

On October 23 from 1:00 – 2:00 PM (ET), the Coalition’s IT/Services Committee will host a meeting with Laura Stanton, GSA Assistant Commissioner for the Office of Information Technology Category (ITC). During the meeting, Laura Stanton will provide an update on the ITC’s latest priorities and initiatives.

To provide topics and questions for the meeting, please contact Joseph Snyderwine at JSnyderwine@thecgp.org. To provide topics and questions for the meeting, please contact Joseph Snyderwine at JSnyderwine@thecgp.org. The meeting will be held at Deloitte’s Rosslyn office on the 15th floor. Virtual attendance will also be available.

To register, click here. For any assistance with registration, please contact Madyson Whiting at mwhiting@thecgp.org.

Webinar: 2024 (2025 FCPs) Public Law Pricing Update for Covered Drugs, October 28

Please join us for a webinar on October 28 from 12:00 – 1:00 PM (ET) with guest speakers Allison Pugsley with Hogan Lovells and Ted Karnezis with Karnezis Consulting who will provide an overview of what manufacturers should expect and prepare for during the 2025 Public Law Pricing Update process.

For manufacturers of covered drugs with a Federal Supply Schedule (FSS) contract in place with VA, the pricing update season is fast approaching. Calculation data is due back to VA by mid-November, and 2025 contract pricing needs to be established in advance of January 1, 2025.

Some of the topics that will be covered include:

- Explanation of the statutory calculation utilized to derive Federal Ceiling Prices (FCPs)

- Summary of VA’s published guidance regarding covered drug pricing updates, including VA’s Public Law timelines and the types of potential disputes a manufacturer may need to raise

- Analysis of pricing calculation data prior to submission to VA

- Recap of VA’s webinar on the 2024 reporting and 2025 Public Law Pricing Update process

- Procedure for modifying FSS contracts to incorporate 2025 covered drug pricing, including how to obtain price increases

To register, click here. For questions or assistance with registration, please contact Madyson Whiting at MWhiting@thecgp.org.

MAS Basic Training: The Nuts & Bolts, October 30

The Coalition for Government Procurement is pleased to announce that on October 30, we will once again hold our MAS Basic Training: The Nuts & Bolts course – an intensive, one-day training workshop that teaches the basics of utilizing the General Services Administration (GSA) Multiple Award Schedule (MAS) program. This training will be taking place at Miller & Chevalier Chartered (900 16th St. NW, Washington, D.C. 20006), but will be offered to both in-person and virtual attendees.

Topics covered during the training will include:

- Obtaining Your GSA Schedule or Schedule Modification, along with Option Extensions

- Navigating the Price Negotiation Process

- Better Understanding Management and Compliance of the Price Reduction Clause

- Schedule e-Tools: Tips on Competing and Winning Through the GSA Schedule Program

- The Keys to Understanding the Task Order Competition

- Audits – How to Prepare and What They Mean in the Current Market

- Ethics and Schedule Business – How to and How Not to Conduct Federal Business

- Small Business Issues and Considerations

Agenda

- 8:30 AM: Welcome/Introduction – Roger Waldron, President, Coalition for Government Procurement, and Jason Workmaster, Member, Miller & Chevalier Chartered

- 8:45 AM: The GSA Schedules Program: An Entry Point to Government Contracting – Robin Bourne, Subject Matter Expert, The Gormley Group

- 10:00 AM: Obtaining Your Schedule or Schedule Modification, plus GSA Option Extensions – Sonia Pesantes, Director of Consulting, and Andrew Sisti, Principal Consultant and GSA Systems Subject Matter Expert, The Gormley Group

- 10:45 AM: Break

- 11:00 AM: GSA Schedule Audits – What to Expect – Leo Alvarez, Principal, and Shannon Ridge, Manager, Baker Tilly

- 12:00 PM: Lunch Presentation: Staying Out of Trouble – Compliance and Ethics for Government Contractors – Rob Burton, Partner, Crowell & Moring

- 1:00 PM: Break

- 1:15 PM: Schedules e-Tools: Tips on Competing and Winning Through the GSA Schedule Program – Bill Gormley, President, and Andrew Sisti, Principal Consultant and GSA Systems Subject Matter Expert, The Gormley Group

- 3:00 PM: Break

- 3:15 PM Small Business Considerations – Ken Dodds, Vice President of Acquisition Policy, Coalition for Government Procurement

- 4:15 PM Q&A & Closing Remarks

To register, click here. For questions or assistance with registration, please contact Madyson Whiting at MWhiting@thecgp.org.

Small Business Summit, November 19

The Coalition for Government Procurement is excited to host a Small Business Summit on November 19 from 9:00 AM – 12:00 PM (ET)! Mark your calendars for this three-hour forum, which features remarks and insights from government and industry subject matter experts.

The event will include an SBA regulatory update with John Klein, SBA Deputy General Counsel providing an update on small business regulatory policy developments.

The Summit will also feature a panel on Enforcing Workshare Requirements under Teaming Agreements, Subcontracts, and Joint Venture Agreements with committee co-chairs, Ken Dodds, General Counsel and Vice President of Acquisition Policy at the Coalition for Government Procurement; David Black, Partner at Holland & Knight; Jon Williams, Partner at PilieroMazza and moderator Jim Wrigglesworth, Vice President of Wrigglesworth Enterprises.

The meeting will take place at CACI (12021 Sunset Hills Road, Reston, VA 20190), with virtual attendance also available. For any questions regarding registration, please contact Mady Whiting at mwhting@thecgp.org.

Upcoming GSA Professional Services Webinars and Trainings

With the start of the new fiscal year approaching, GSA’s Office of Professional Services and Human Capital (PSHC) is hosting several industry and customer webinars to simplify buying and selling services in the Federal marketplace. Click here for more details and registration.

- OASIS+ DPA Training: October 1 from 1:00 – 2:30 PM (ET)

- OASIS+ Overview Training: October 2 from 1:00 – 2:00 (PM) ET

- Office Hours: FAR 8.4 and FAR 15: Roles of Each in Acquisition Strategy: October 10 from 1:00 p.m. – 2:00 PM (ET)

- Overview of CPRM for OASIS & HCaTS: October 16 11:00 AM – 1:00 PM (ET)

- OASIS+ DPA Training: October 23 from 1:00 – 2:30 PM (ET)

- OASIS DPA Training: October 29 from 1:00 – 2:00 PM (ET)

DHS PIL Boot Camps for Industry – October 16 and November 20

The Department of Homeland Security’s (DHS) Procurement Innovation Lab (PIL) is hosting two upcoming virtual PIL Boot Camp and PIL Boot Camp – The Next Level training events.

October 16 from 8:00 AM to 12:00 PM (ET): During this training, you will see examples of how DHS procurement teams innovated the procurement process to improve mission outcomes and share your innovative ideas with those focused on solving the same challenges you face. The training covers ten innovative procurement techniques. Learn more and register here.

November 20 from 8:30 AM – 3:00 PM (ET): This one-day training takes a deep dive into how to right-size the original PIL Boot Camp techniques while teaching nine additional innovative procurement techniques tested by DHS procurement teams. Learn more and register here.

Don’t Miss the 2024 FPS Government Contracts Year in Review!

For over four decades, this industry-leading conference has been the essential gathering for government contracting professionals. Join Federal Publications Seminars (FPS) on December 4-5 at The Westin in Tyson’s Corner, Washington, DC, to delve into the most critical legal and compliance issues impacting Federal contracting in 2024. Network with peers, gain insights from top experts, and stay ahead of industry trends. As a Coalition member, enjoy a $200 discount with promo code 200DCYIRFPS2024.

To register, click here.

VA Data for Healthcare Members

To increase the number of valuable tools available for members, the Coalition has compiled several data sets pertaining to VA Medical Centers’ procedures, diagnoses, and product spend. Below is a description of the different VA data reports that the Coalition can provide to healthcare members based on areas of interest to their business:

- Diagnosis data by each VA Medical Center: Members can request a report by providing the relevant International Classification of Diseases (ICD)-10 codes of interest to their business.

- Procedure data by each VA Medical Center: Members can request a report by providing the relevant Current Procedural Terminology (CPT) codes of interest to their business.

- Prosthetic (medical implants, DME) product spend by VA Medical Center: members can request a report by providing the relevant Healthcare Common Procedure Coding System (HCPCS) codes of interest to their business for items managed by VHA Prosthetics.

For any data requests or related questions, please contact Michael Hanafin at mhanafin@thecgp.org.